Introduction: – What is PCR Ratio?

Today, we’ll talk about PCR Ratio (Put Call Ratio) and how it’s used in the market. Using PCR Ratio, you can estimate the market direction by analyzing Nifty and Nifty Bank… But first, let’s understand what PCR Ratio is all about. In Indian stock markets, traders and investors use various indicators and fundamental studies to understand the market. PCR Ratio is one such indicator that shows the market’s indication. PCR, or Put-Call Ratio, is a popular technical indicator used by traders and investors to gauge market sentiment. It’s calculated by dividing the total number of outstanding put options by the total number of outstanding call options. Put options give the holder the right to sell an asset at a specified price within a specified time frame, while call options give the holder the right to buy an asset at a specified price within a specified time frame.

Understanding PCR in Nifty and Bank Nifty:

Nifty and Bank Nifty are two major indices in the Indian stock market representing the performance of the top 50 stocks on the National Stock Exchange (NSE) and the top banking stocks, respectively. In these indices, PCR Ratio Nifty and PCR Ratio Nifty Bank provide valuable insight into market sentiment and potential future movements.

Interpreting PCR Ratio:

PCR Ratio values above 1 indicate a bearish sentiment in the market because there are more outstanding put options relative to call options. This suggests that investors are inclined towards negative protection, anticipating potential declines in prices.

Conversely, PCR Ratio values below 1 indicate a bullish sentiment as there are more outstanding call options relative to put options. This suggests that investors are optimistic about the market moving upwards.

Example:

Let’s consider an example of how PCR works in Nifty and Bank Nifty. Assume the current PCR for Nifty is 1.2, and for Bank Nifty, it’s 0.8.

For Nifty: A PCR of 1.2 indicates that for every outstanding call option, there are 1.2 outstanding put options. This indicates a slight bearish sentiment in the market as investors seek protection against potential negative risks.

For Bank Nifty: A PCR of 0.8 indicates that for every outstanding call option, there are 0.8 outstanding put options. This indicates a bullish sentiment in the market as investors show a preference for upward movements.

Importance of PCR in the Share Market:

PCR helps traders identify potential market trends. Significant increases or decreases in PCR can signal changes in market sentiment. It can also be used as a contrarian indicator. Extremely high or low PCR values can suggest overbought or oversold market conditions, indicating potential reversals in trend.

Power of Nifty Option Chain’s Put Call Ratio

Imagine having a secret peek into what other traders are up to in the market. Well, that’s almost what you get with the Put Call Ratio (PCR) of Nifty Option Chain. It’s like having a report card on market sentiment, revealing whether traders are leaning towards puts or calls.

What’s PCR?

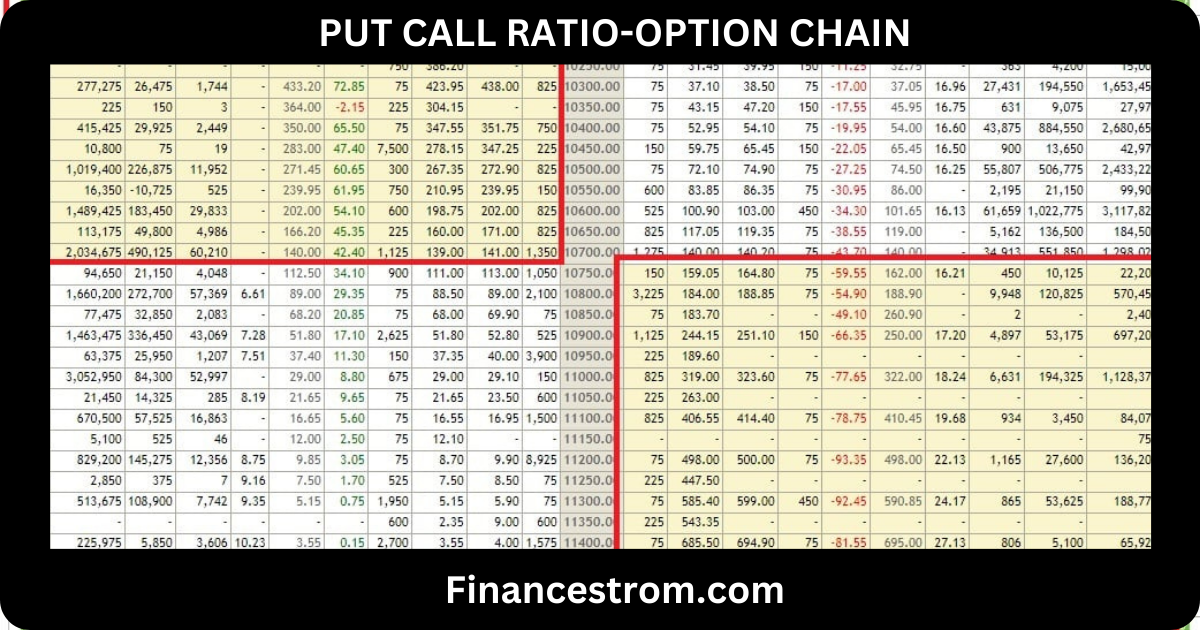

PCR measures the ratio of open put options contracts to open call options contracts in the Option Chain. It’s a simple formula: divide the open interest of puts by the open interest of calls. This data is readily available in the Nifty option chain. Gone are the days of crunching numbers in Excel. With PCR, you can quickly gauge market sentiment without the hassle of downloading and calculating separate open interest data.

Using PCR in Your Trade Plan

Here’s how I leverage PCR in my trading strategy. Let’s say everyone’s feeling bearish, entering shorts and buying puts. But when everyone’s already on the bear train, there’s nobody left to sell. As stops get hit, shorts start covering, driving the market higher. Eventually, everyone turns bullish, buying in, until there’s no one left to buy, and the market reverses.

Golden Rule

If PCR stays below the previous day’s closing PCR, I lean towards short setups. If it’s above, I look for long trades.

PCR and Nifty Spot Price Correlation

Watching the correlation between PCR and Nifty spot price can be gold for day trading. Here’s how to interpret it:

– Increasing PCR during a correction in an uptrend suggests bullishness.

– Steadily rising PCR alongside Nifty spot is also bullish.

– Declining PCR near resistance levels signals bearishness.

– Decreasing PCR during a correction in a downtrend indicates bearishness.

How to calculate pcr ratio: –

Calculate PCR: Once you have the open interest data for both put options (OI_put) and call options (OI_call), use the following formula to calculate the PCR:

PCR = OI_put / OI_call

Divide the total open interest of put options by the total open interest of call options to get the PCR value.

PCR RATIO NIFTY VIDEO: –

The PCR ratio for Nifty is calculated by dividing the total open interest of put options by the total open interest of call options, indicating market sentiment.

Video Credit:- VRDNation

Conclusion:

Understanding PCR in Nifty and Bank Nifty is essential for traders and investors in the Indian stock market. By analyzing PCR values, you can gain insight into prevalent market sentiment and make informed decisions about your trading strategies. However, it’s important to remember that PCR is just one of many indicators used in technical analysis, and comprehensive market analysis should consider other factors as well.