Introduction: What is Nifty?

What is nifty? What is nifty 50? The full name of Nifty is ‘National Fifty’; This is the main list of NSE (National Stock Exchange). Nifty started in 1996 under the name of CNX Nifty. It came to be known as Nifty 50 in 2015. Nifty follows 50 of the largest and easiest to withdraw stocks out of over 1,600 stocks listed on the NSE. These 50 largest companies are from various industrial sectors and together give an indication of India’s economy and stock market. Nifty is followed by India Index Services & Products Limited (IISL), a joint venture of the National Stock Exchange and CRISIL. We’ll cover all you need to know about NIFTY 50 and how to invest in it to generate significant long-term wealth in this blog.

Key Components of the Nifty:

Understanding the composition of the Nifty is crucial for investors. The index includes stocks from various sectors such as finance, technology, consumer goods, and healthcare. Some of the key components of the Nifty include well-known companies like Infosys, Reliance Industries, HDFC Bank, and Tata Consultancy Services.

Share price nifty 50? and what is the share price of nifty 50?

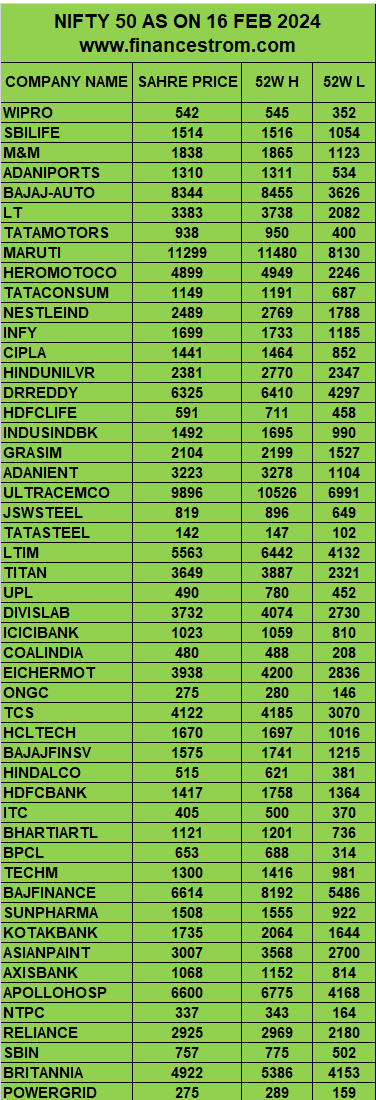

Currently Nifty 50 is Tarding 22040 as on 16 feb,2024 and its Main Components as below: –

Please find the NSE Active Price above, and for the most up-to-date information, kindly follow the link provided below. Stay informed and make informed decisions about your investments by accessing the latest active prices through the provided link. The Link for Active Nifty 50 Price: –https://www.nse.com The stocks included in the Nifty 50 represent a carefully selected group of 50 of the largest and most liquid companies listed on the National Stock Exchange of India. The company should have a permanent office in India and should be listed and traded on the National Stock Exchange (NSE).

The company should be included in the Nifty 100 list and it should be available for trading in the futures and options zone of NSE so that it can be included in the Nifty 50 list.

The company’s average free-market valuation must be 1.5 times higher than the valuation of the smallest company on the list. In the last six months, the stock must be traded daily (100%)

How is NIFTY made?

1) The company should have a permanent office in India and should be listed and traded on the National Stock Exchange (NSE).

2) The company should be included in the Nifty 100 list and it should be available for trading in the future and options sector of NSE so that it can be included in the Nifty 50 list.

3) The average free-market valuation of the company should be 1.5 times higher than the valuation of the smallest company on the list.

4) In the last six months, the stock should be trading daily (100% trading frequency).

How is Nifty calculated?

The Nifty is calculated by the float-adjusted, market valuation-weighted method. The total market value of all the stocks in the list reflects relative to a particular base period. The base price of Nifty is 1000, and the base market capitalization is ₹2.06 trillion.

Value of inventory = Current Market Value / (Base Market Capital x 1000)

Note * The base year of Nifty is 1995.

As you have already learnt the meaning of Nifty, it consists of the largest companies from different industrial sectors, which together form the foundation of India’s economic trends. Similarly, there are also some sectoral indices that follow the performance of stocks in a particular sector.

Why Does the Nifty Matter?

The Nifty serves several important purposes in the financial world. It provides a broad overview of the performance of the Indian stock market, serving as a barometer for investors, traders, and policymakers. The Nifty is also used as a benchmark against which the performance of mutual funds, index funds, and other investment products is measured.

How to invest in the Nifty index?

You can invest in Nifty through Nifty Future, index mutual funds and exchange-traded funds (ETFs). These funds invest in stocks that mirror the gains of indices like Nifty or Sensex. The main difference between mutual funds and ETFs is that the prices of ETFs are actively updated throughout the day, just like stocks, and they can be bought and sold at live prices. On the other hand, the prices of mutual funds are updated only at the end of the day and they can be bought and sold based on the end-of-day price.

Different Types of Nifty Index

Some of the Nifty Index are listed below:

1) Nifty Auto Index: The index represents the overall behaviour and performance of the automobile sector in India. Top automobile stocks included in the index: Bharat Forge Limited, Exide Industries Limited

2) Nifty Bank Index: The index represents the overall behaviour and performance of the banking sector in India. Top banking stocks included in the index: ICICI Bank, Axis Bank, HDFC Bank, State Bank of India

3) Nifty Media Index: The index represents the overall behaviour and performance of the media and entertainment sector in India. Top Media & Entertainment Stocks Included in the Index: PVR LIMITED, INOX LEISURE, ZEE ENTERTAINMENT, ENTERPRISES LIMITED, SUN TV, NETWORK

4) NIFTY IT INDEX: The index represents the overall behaviour and performance of the IT sector in India. Top information technology stocks included in the index: Tata Consultancy Services Limited (TCS) Limited ,Tech Mahindra Limited,

5) Nifty Pharma;- The index represents the overall behaviour and performance of the pharmaceutical sector in India. The top pharmaceutical stocks included in the index are: REDDY’S LABORATORIES LIMITED, DIVI’S LABORATORIES LIMITED CIPLA LIMITED, ALKEM LABORATORIES LIMITED. The Indian market and the entire economy is also measured through another index Sensex. It is the oldest index in India. Nifty and Sensex sound very similar to each other, but there is a lot of difference between the two.

Major events in NIFTY’s history from 1996 to 2024:-

These events and price ranges provide a snapshot of NIFTY’s journey, showcasing its resilience, milestones, and the impact of global economic events on the Indian stock market.

| www.financestrom.com | ||||

| Year | Event | Description | Low Range | High Range |

| 1996 | Inception of CNX Nifty | The CNX Nifty was introduced as India’s first index, comprising 50 stocks from various sectors. | 664.6 | 1120 |

| 2000 | Dot-com Bubble | Nifty experienced volatility due to the burst of the dot-com bubble, impacting global markets. | 795.35 | 1592.9 |

| 2008 | Global Financial Crisis | Nifty witnessed significant declines amidst the global financial crisis, affecting investor confidence. | 2252.85 | 6357.1 |

| 2015 | Transition to Nifty 50 | CNX Nifty rebranded as Nifty 50, maintaining its position as the benchmark index of NSE. | 7200.75 | 9119.2 |

| 2017 | Crossed 10,000 Points Mark | Nifty breached the historic 10,000-point milestone, reflecting strong market performance. | 9445.4 | 10490.45 |

| 2020 | Resilience During COVID-19 Pandemic | Nifty exhibited resilience amid market volatility caused by the global COVID-19 pandemic. | 7511.1 | 12362.3 |

| 2021 | Introduction of Sectoral Indices | NSE introduced sectoral indices under the Nifty umbrella, offering insights into specific industries. | 13461.45 | 18616.15 |

| 2023 | International Recognition | Nifty gained recognition as a benchmark for emerging market investments, attracting global investors. | 18293.4 | 24081.85 |

| www.financestrom.com | ||||

What is NIfty and Sensex Video.

What is NIFTY & SENSEX? What is Index? Share Market Basics Explanation for Beginners

Video Credit:- marketfeed

FAQ’s:-Frequently Asked Question

1). Nifty Full Form: -The full form of NIFTY is “National Stock Exchange Fifty”.

2). What is Nifty and Sensex: –

Nifty: It’s a collection of 50 big companies listed on the National Stock Exchange. Think of it as a snapshot of how these companies are doing overall.

Sensex:– This one covers 30 of the largest and most actively traded companies on the Bombay Stock Exchange. It’s like a barometer for the health of India’s stock market.

Both indices give investors an idea of how the stock market is performing and help them make decisions about buying or selling stocks.

3). Bank Nifty Meaning: – Bank Nifty represents a group of major banking stocks listed on the National Stock Exchange (NSE) of India. It’s like a team of top banks coming together in one index. Bank Nifty gives investors an idea of how the banking sector is doing in the stock market. So, if you hear about Bank Nifty going up or down, it means the overall performance of these banks is being tracked.

4). Nifty Calculation Formula: -simple terms, you’re just adding up the values of all the companies in the Nifty 50 and then dividing by a specific number to get the index value.

Conclusion:

The Nifty serves as a crucial guide for anyone exploring the Indian stock market. Understanding its basics empowers investors to make smarter choices and steer their investments wisely according to market patterns. Whether you’re diving deep into investing or just dipping your toes, getting a grip on the Nifty is key to thriving in the stock market realm.